Long term disability insurance is critical to protect your income if you were to have a serious illness or accident that could prevent you from practicing medicine. Long term disability coverage usually starts about 90 to 180 days after you become disabled, depending on the policy you have chosen.

Have you considered how you will pay your bills and maintain your income until the long term disability coverage becomes effective? Last year, CAP Agency introduced a new program to help our doctors fill in the waiting period that occurs on most long term disability policies.

Since the core disability benefit provided to you with your CAP membership has changed to a 180 waiting period, this new Short Term Disability Plan is a great way to fill that gap.

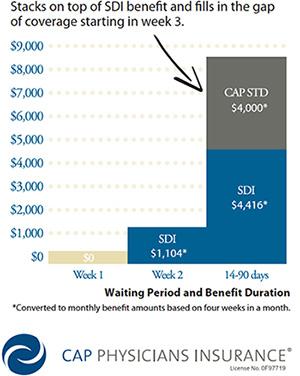

The CAP Short Term Disability Plan1 stacks on top of your State Disability Insurance (see right) and provides coverage to fill that waiting period gap.

- $1,000 weekly benefit or $4,000/month benefit

- 14-day elimination/waiting period

- 11-week or 24-week benefit period

- No medical or income documentation needed

- No income limitation

State Disability Insurance (SDI)*

According to the State of California Employment Development Department, an individual’s weekly benefit amount is approximately 55 percent or $1,104, whichever is less, based on personal earnings for a maximum benefit period of 52 weeks with a waiting period of seven days.

CAP Short Term Disability Plan

A participant in the CAP Short Term Disability Plan can receive a weekly benefit of $1,000 on top of SDI, with a benefit duration of 11 or 24 weeks. This helps fill the the gap for any required 90 or 180 day long term disability policy waiting period.

1 Must be working at least 17.5 hours per week and not currently disabled to apply; pre-existing exclusions do apply

*Based on the 2015 calendar year